In a major The New Indian impact, the Central Board of Indirect Taxes and Customs (CBIC) initiated a probe into the ₹37.5 lakh Goods and Services Tax bill slapped on a poor farmer in Bihar’s Khagaria.

In a major The New Indian impact, the Central Board of Indirect Taxes and Customs (CBIC) initiated a probe into the ₹37.5 lakh Goods and Services Tax bill slapped on a poor farmer in Bihar’s Khagaria.

The New Indian correspondent, under whose byline this story is being published, was the first one to take up the cause of Girish Yadav on social media.

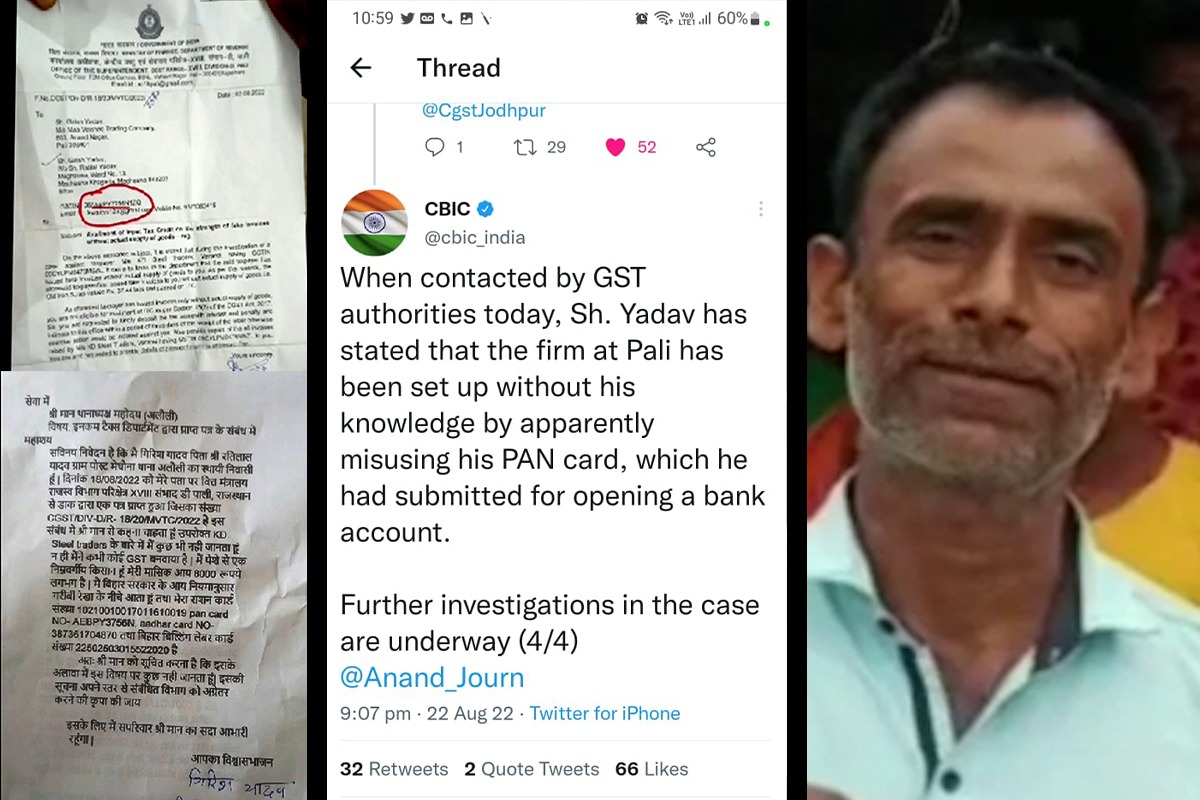

A day after The New Indian highlighted how a poor farmer in Bihar’s Khagaria received a GST notice of ₹37.5 lakh, the CBIC on Monday said that they had contacted the victim and found that the firm in Rajasthan’s Pali was set up “without his knowledge” by apparently misusing his PAN card, which he had submitted for opening a bank account.

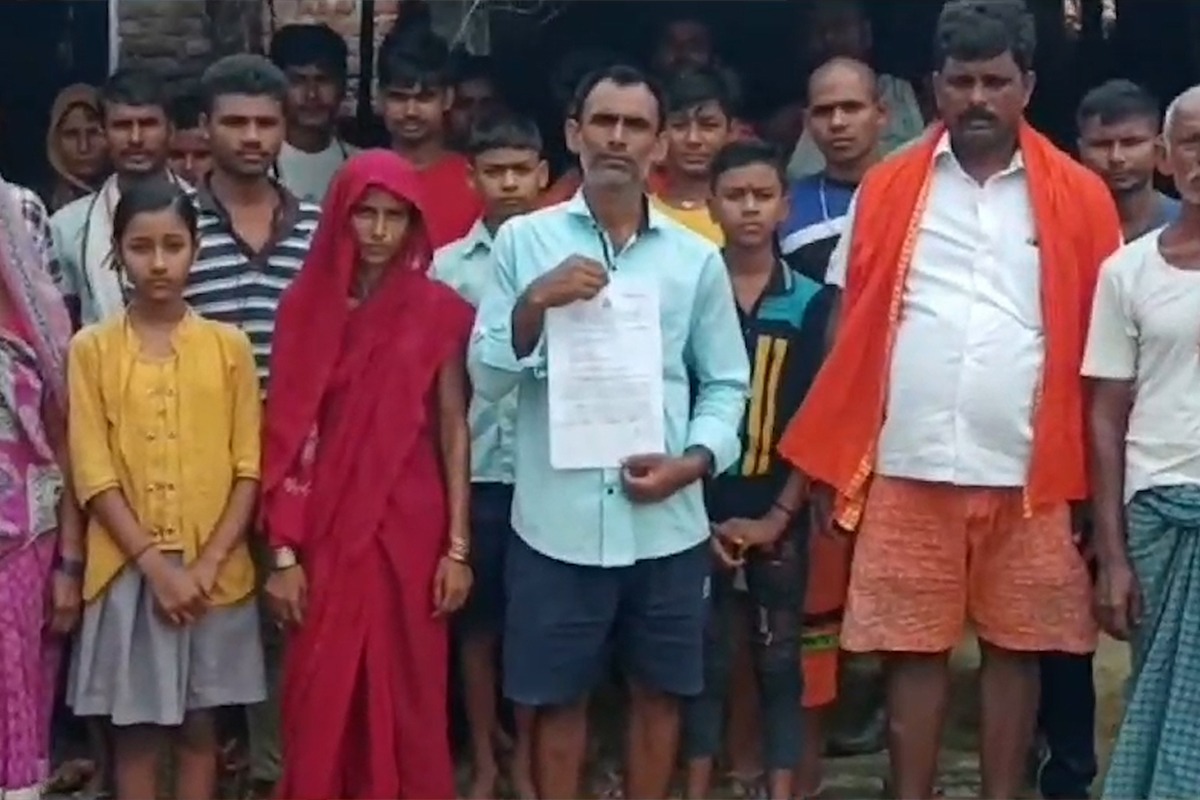

The story started when The New Indian correspondent posted a video of Girish Yadav, a resident of Bihar’s Khagaria Maghauna village under Alauli block, on Twitter on Sunday evening. In the video, Yadav was seen narrating his ordeal, how he had received a GST notice of ₹37.5 lakh.

A poor farmer in Bihar's Khagaria gets a Rs 37.5 lakh GST Notice. He is now pleading for Justice. pic.twitter.com/U1mJLFOY1t

— Anand Singh (@Anand_Journ) August 21, 2022

Following the video on social media, the CBIC took note of the complaint of Bihar’s farmer and swung into action.

On Monday, in a series of tweets, the CBIC said, “Recent reports in a section of the media have highlighted a case of Girish Yadav, a resident of Khagaria, Bihar having received a letter from the jurisdictional GST authorities for recovery of GST amounting to ₹37.5 lakh along with applicable interest and penalty.”

It said that during the examination of the case by CGST authorities, it was revealed that the letter was issued to Yadav in his capacity as proprietor of a firm by the name of Maa Vaishno Trading Company, Pali, Rajasthan.

The authorities also revealed that the company had obtained a GST registration based on Yadav’s PAN Card. “The said firm had allegedly wrongly availed Input Tax Credit worth ₹37.5 lakh based on goods-less invoices – an offence under the GST Law,” it said.

When contacted by GST authorities today, Sh. Yadav has stated that the firm at Pali has been set up without his knowledge by apparently misusing his PAN card, which he had submitted for opening a bank account.

Further investigations in the case are underway (4/4) @Anand_Journ— CBIC (@cbic_india) August 22, 2022

The CBIC tagging this correspondent replied in its last tweet said, “When contacted by GST authorities today, Yadav has stated that the firm at Pali has been set up without his knowledge by apparently misusing his PAN card, which he had submitted for opening a bank account. Further investigations into the case are underway. @Anand_journ”.

The prompt reply from the CBIC has won the trust of the poor family, who were running from pillar to post in Khagaria on Sunday to lodge a police complaint.