Individuals with an annual income of ₹9 lakhs will be required to pay only ₹45,000 under the new tax slab, FM Sitharaman announced.

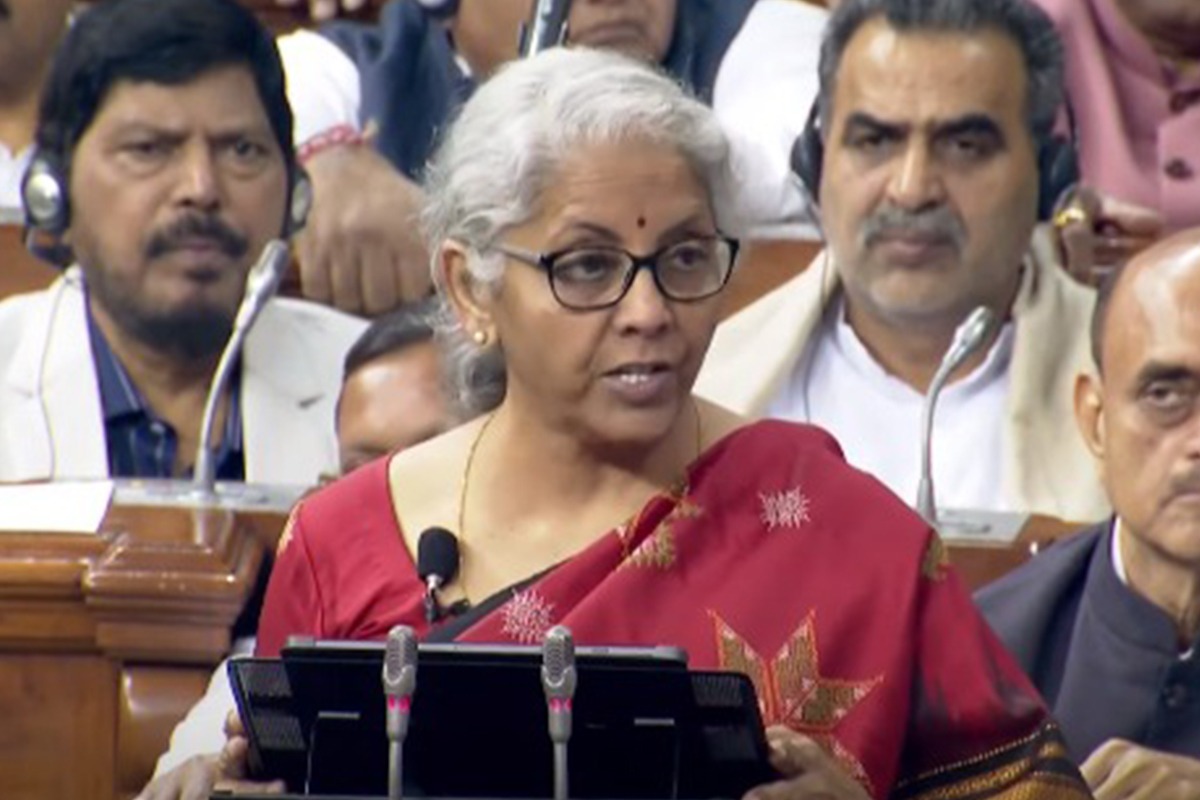

In a major relief for the middle class, finance minister Nirmala Sitharaman on Wednesday announced that there will be no tax for salaried persons earning ₹7 lakhs per year under the new personal income tax regime.

Individuals earning more than ₹3 lakhs per annum will require filing their income tax returns but will be eligible for different kinds of rebates.

People with a yearly income of ₹3-6 lakh will need to pay 5 per cent, those earning ₹6-9 lakhs will have to pay 10 per cent of their income, and those getting ₹9-12 lakh per year will have to pay 15 per cent as the personal income tax under the new regime.

As per the new tax slab, a yearly income of ₹12-15 lakh will attract a tax of 20 per cent and those earning more than ₹15 lakhs per annum will have to pay 30 per cent in taxes.

Salaried persons earning up to ₹7 lakhs per annum will be eligible for tax rebates and effectively pay no taxes. “Now I come to what everyone is waiting for, primarily benefit for the hardworking middle class. I propose to increase the rebate for the tax to ₹7 lakhs from ₹5 lakhs,” FM Sitharaman said.

ALSO READ: Agri fund, millet centre, more credit: What Budget offers to farmers

“The new tax regime will provide major relief to all taxpayers. Individuals with an annual income of ₹9 lakhs will be required to pay only ₹45,000. This is only 5 per cent of his or her income. It is a reduction of 20-25 per cent what he or she is required to pay now i.e. 60,000,” the finance minister announced.

“Similarly, an individual with an income of ₹15 lakhs will be required to pay only ₹1.5 lakhs or just 10 per cent of their income – a reduction of 20 per cent from the existing liabilities of ₹187500,” she said.

Reading out the Budget in the Lok Sabha, the FM announced a reduction in the number of personal income tax slabs from six to five for the year 2023-24.

With an aim of luring high-net individuals and a business-friendly environment, the finance minister also announced to reduce the tax rate for high-net-worth individuals (HNIs).

“The highest tax rate in our country is 42.74 per cent. It is among the highest in the world. I propose to reduce the highest surcharge rate from 37 per cent to 25 per cent in the next tax regime,” she announced amid a round of applause by the treasury benches.