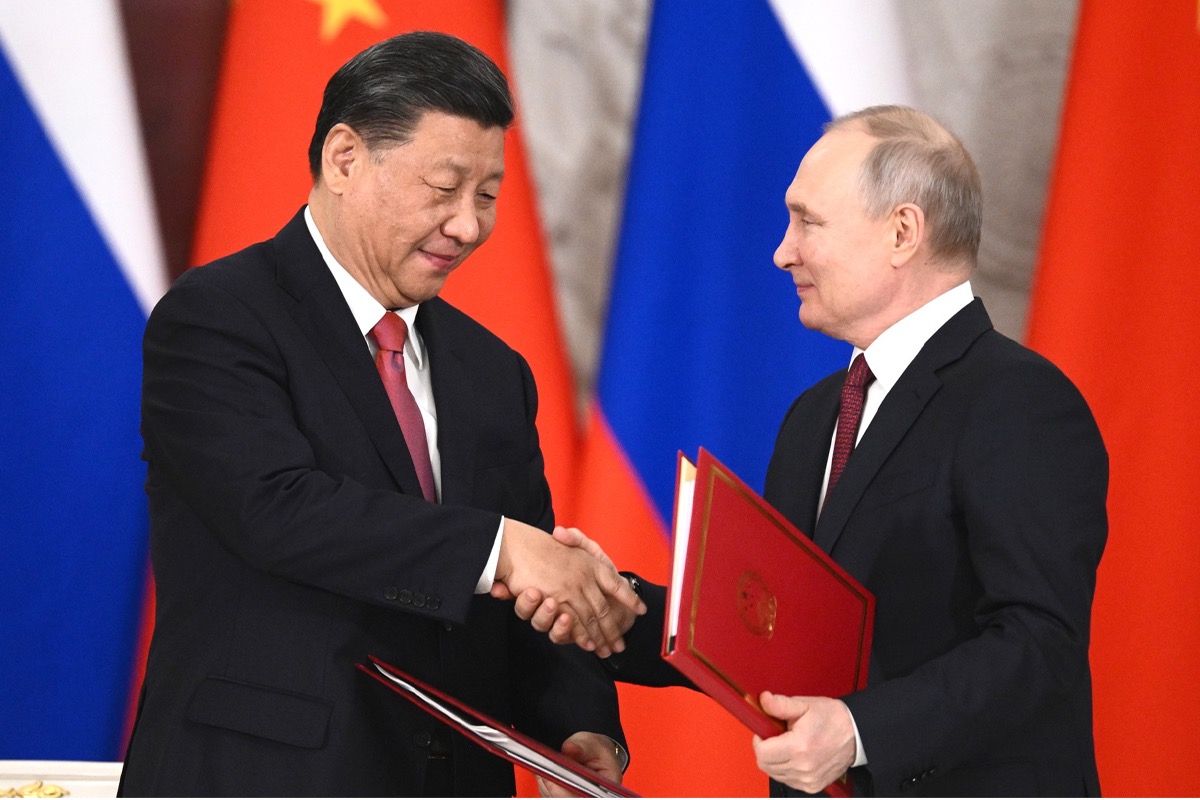

Parting after a series of meetings with Russian President Vladimir Putin in Moscow a few days ago, Chinese President Xi Jinping spoke of “changes, the likes of which we have not seen for a hundred years.” A 100 years! And, he added: “we are the ones driving these changes together.”

Putin responded that he agreed, after which Xi told him to “take care, my friend.” That was a slap in the face of the Western portrayal of Putin as a great fiend, against whom an international warrant of arrest had recently been issued.

But it signalled more than that. Those few seconds gave us a glimpse of how potent this time may be in history. I don’t think Xi was talking about the war in Ukraine, for no one would think that that war is — at least yet — bigger than World War II. Nor do I think Xi wants to get drawn into an outright third world war.

Then, to what was he referring?

A challenge to US dominance?

It is worth noting here that the US replaced Britain as the world’s pre-eminent power about a century ago. For much of this time, the US has dominated world trade, thanks mainly to the Bretton Woods agreements after WW II, and the US’s naval dominance over the oceans since then.

It is possible that Xi was talking of a Sino-Russian effort to undermine the predominant position of the US dollar as the world’s reserve currency. That could weaken the US economy, and cause a geopolitical power shift. No doubt the US would resist, sooner or later. That could lead to an aggressive round of power play.

ALSO READ: Secessionist provocation from British soil isn’t new; it’s time to act

Nevertheless, there are signs that such a shift is underway, and China and Russia appear to be its prime movers. Saudi Arabia and Iran too seem to be key players — and China’s recent brokering of rapprochement between those two countries could be a key chess move on the road to this shift.

The recent announcement that Saudi Arabia would accept payments for oil in currencies other than the US dollar was quite historic. For, the US dollar has been the standard payment instrument for oil since the 1970s. That exclusive role was part of an arrangement under which the US undertook the defence of the Saudi kingdom.

That pact seems to be coming apart. Saudi Arabia’s climb in recent years to the top position among the world’s importers of arms has been notable. (It has recently spent slightly more than India, which had long held the top spot.) Those imports clearly signalled that the Saudis did not want to depend on the US for their kingdom’s defence any longer. No doubt Russia and China would fervently wish that. For its part, Iran is, of course, more than happy to get out of dollar entanglements.

A new gold-backed currency?

There is even talk of the BRICS grouping sponsoring an alternate, possibly gold-backed currency — a putative alternative to the US dollar. There is simultaneous talk of BRICS being expanded to include countries such as Saudi Arabia. Indonesia, Argentina, Nigeria, the UAE, Egypt, and Algeria are among other countries that also wish to join.

ALSO READ: NATO paradox and other American miscalculations

A possible warning sign is that several central banks have purchased large amounts of gold in recent years, and that — led by Germany — many countries have sought over the past decade to withdraw their gold reserves from US vaults.

The decision by the world’s major oil exporters, led by Saudi Arabia, in the early 1970s to conduct oil trade only in US dollars is a prominent pillar on which the dollar’s global domination stands. Another pillar is the fact that the World Bank and IMF give loans in dollars.

On its own, the US currency has had an uncertain foundation since President Nixon delinked it from gold in 1971. That foundation has become shakier as the US national debt has ballooned in recent years.

Therefore, if several important trading countries opt to settle dues in a currency other than the US dollar, the US economy could be thrown into crisis. Particularly since the 2008 financial crisis, the US has run up very large debts (currently estimated at more than 30 trillion dollars). The country has felt safe to print more and more dollars largely because it is the world’s reserve currency, and so would continue to be used even if it is backed by less and less value. One should point out here that US treasury bonds are held by a range of countries, including China and Saudi Arabia.

As a founding member of BRICS, India would be a key decision-maker if indeed a BRICS+ currency is officially mooted. That would be a piquant decision for India as it adroitly walks a tightrope over the minefield of international affairs.

We live in interesting times.

(David Devadas is a journalist and security, politics and geopolitics analyst.)

Disclaimer: Views expressed above are the author’s own.