NEW DELHI: The Burman family, which is the promoter of the leading Ayurveda major Dabur Group has courted a fresh controversy, after CBI sources said that it is widening its probe into transactions done by a basmati rice export company for defaulting more than Rs 700 crore to a consortium of banks between 2010 and 2016 following a consultancy agreement signed by Mohit Burman.

Burman, who is already facing a Mumbai Police FIR in connection with the illegal betting racket in Mahadev App betting scandal case as well a SEBI probe into the accusation of share manipulation and mega investment into Religare Enterprises will be probed over his transactions with basmati rice exporter company Bush Foods and its owners Vir Karan Awasthy and Radhika Awasthy, who had escaped to London.

READ MORE: Online betting FIR By Mumbai Cops: Dabur owner Burmans named accused

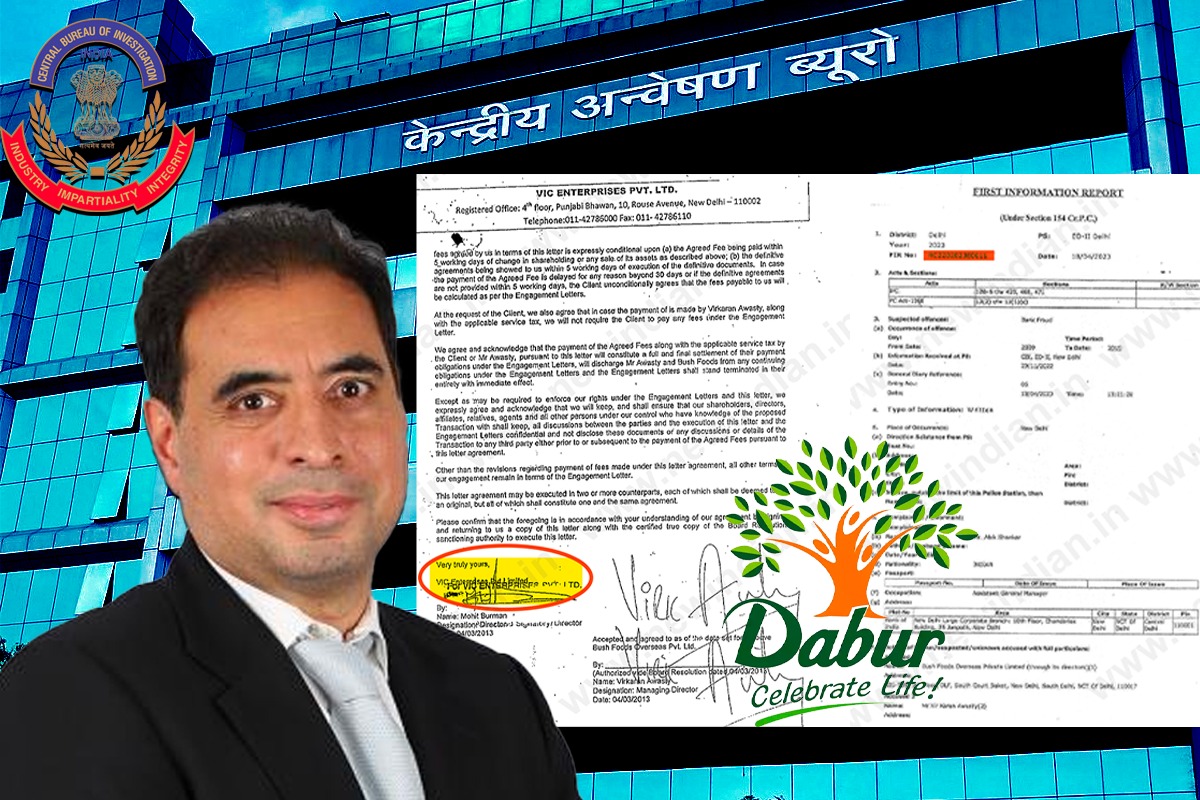

The New Indian is in the possession of the CBI FIR dated April 18, 2023, the copy of the agreement for providing consultancy services by Burman through his company VIC Enterprises Private Limited (signed by Mohit) and Bush Foods Overseas Pvt Ltd d on October 23, 2010 as well as the letters sent by six different banks for the recovery of money from Bush Foods and subsequent complaint for the CBI.

The agreement letter signed by Burman in 2010 had guaranteed a sum of Rs 13.7 crore as his consultancy fee to facilitate an alliance between Bush Foods had Qatar-based group Hassad for a mega investment via Netherlands.

“As recorded in the said engagement letters, we introduced the client (Bush Foods) to the Hassad Group of Qatar which is owned by Qatar Investment Authority). Furthermore, it was agreed as per the engagement letters that while our services were not required beyond October 2011, should the client (Bush Foods) enter into an alliance with the Hassad Group of Qatar at any time even beyond October 2011, we would be entitled to the fee as per the engagement letters. The client has requested that due to the fact that economic circumstances have changed. Based on our relationship, and subject to the client’s adherence to the terms of this letter, we have accepted the request and agree that the aggregate fees payable by the Client and Awasty stands reduced to Rs 13.7 crore with service Ttx arising out of the agreed Fees shall be paid in addition to the agreed fees,” reads the 2010 contract signed by Mohit on behalf of VIC and Bush Food.

VIC is the same company that is making investments into Religare that has been challenged before Securities and Exchange Board of India (SEBI).

While Qatar-based Hassad group acquired business of Bush Foods, India’s financial institutions detected that Bush Foods was doing a fraudulent business under the guise of rice and paddy export.

The banks, in their FIR said, that Bush Foods and others nearly defaulted for Rs 700 crore before the Qatar based company Hassad returned more than 70 % of the money later. However, the banks wrote to Delhi Police and then CBI on October 7, 2022 that Bush Foods & others have cheated the consortium of banks to the tune of Rs 163.4 crore to the consortium member banks.

The CBI’s FIR filed in 2023 under sections 120-B with 420, 468 & 471 of IPC and prevention of corruption (PC) act mentions bank officials and Bush Foods.

Though Burman is not named as an accused in the case so far, CBI sources told The New Indian that they want to scrutinise all transactions done by him with Bush Foods.

The banks, in their FIR, have also told the CBI, that their investigations detected that that loan disbursed from consortium was not repaid, with payments becoming irregular and no repayments while also claiming unavailability of physical stock of rice and paddy.

“In 2013, the loan was disbursed. However, the banks noticed that the accounts of Bush Foods, were becoming irregular and repayment were not received as per sanctioned terms. The banks then classified its account as NPA. From the stock audit it was evident that, the promoters/directors and/ or the guarantors with dishonest intention have caused wrongful loss to lending banks and wrongful gain to themselves by means of fraudulent and suspicious transactions, mainly by act of diversion and siphoning of income generated from the Project & falsified statements of Stock & Book Debt. We request for thorough investigation by your office as it would detect the complete details about the aforesaid circuitous transactions and the criminal conspiracy thereon,” the CBI FIR in 2023 states.

Overall Rs 270 crore was given as a line of credit from a consortium of the banks in 2009. The Bank of India gave Rs 72 crore, Indian Bank Rs 68 crore, the Bank of Baroda Rs 40 crore, Central Bank of India Rs 60 crore , Punjab National Bank Rs 30 Crore.

Later on November 17, 2011, the consortium also included Exim Bank and Standard Chartered Bank and the credit limit was enhanced to Rs 703 crore.

The banks alleged that Bush Foods was not maintaining any physical verification of the inventory.

“The accused were not maintaining the movement records of Inventory for checking of the ageing of the stock. Also the banks were not able to trace the promoters & their present whereabouts were not available,” the FIR had said.

READ MORE: EXPLOSIVE: SEBI starts probe on Burmans of Dabur amid “Radha Soami’s monies” accusations

Despite repeated emails and texts, there were no replies by Burman on his dealings with Bush Foods.